What Is a Rate Buydown and How Can It Lower Your Mortgage Rate?

Understanding mortgage options can be daunting. One option to consider is a rate buydown.

A rate buydown allows borrowers to lower their mortgage interest rates. This can make monthly payments more manageable. Borrowers pay an upfront fee to buy down the interest rate. This can be a strategic move, especially in high-interest environments.

Rate buydowns can be temporary or permanent. Each type has its own benefits and drawbacks.

In this guide, we'll explore how rate buydowns work. We'll also discuss who can benefit and how to decide if it's right for you.

What Is a Rate Buydown?

A rate buydown is a financing strategy used in mortgage loans. It involves paying an upfront fee to reduce the loan interest rate. This reduction can make mortgage payments more affordable for borrowers.

Borrowers, sellers, or even builders often cover the cost of the buydown. The key aim is to lower the monthly mortgage burden. A buydown can be temporary, lasting a few years, or permanent, lasting the loan's term.

The cost of the buydown is usually calculated in points. One point typically equals 1% of the loan amount.

Benefits of a Rate Buydown:

- Reduces monthly payments

- Makes home buying more accessible

- Can be seller or builder funded

Rate buydowns are especially advantageous when interest rates are high. They provide breathing space during the initial years of home ownership. For those planning to keep a house for long periods, a buydown can lead to significant savings.

How Does a Rate Buydown Work?

A rate buydown works by making upfront payments to lower the interest rate. This payment is usually made at closing. It's calculated based on the loan amount and expressed in points. This upfront cost lowers the borrower's interest rate.

Steps to Implement a Rate Buydown:

- Determine the loan amount and desired interest rate reduction.

- Calculate the number of points required for the buydown.

- Pay the buydown fee at the closing of the loan.

The reduced interest rate leads to smaller monthly mortgage payments. Whether the buydown is temporary or permanent affects how long these benefits last. Temporarily reduced rates last for a few years, often helping new homeowners adjust financially.

When implemented well, a buydown aligns with the borrower’s long-term financial plans. It might involve a small upfront payment but offers larger savings over time. Different scenarios might favor temporary or permanent buydowns. Borrowers can thus choose the option that best suits their needs and budget.

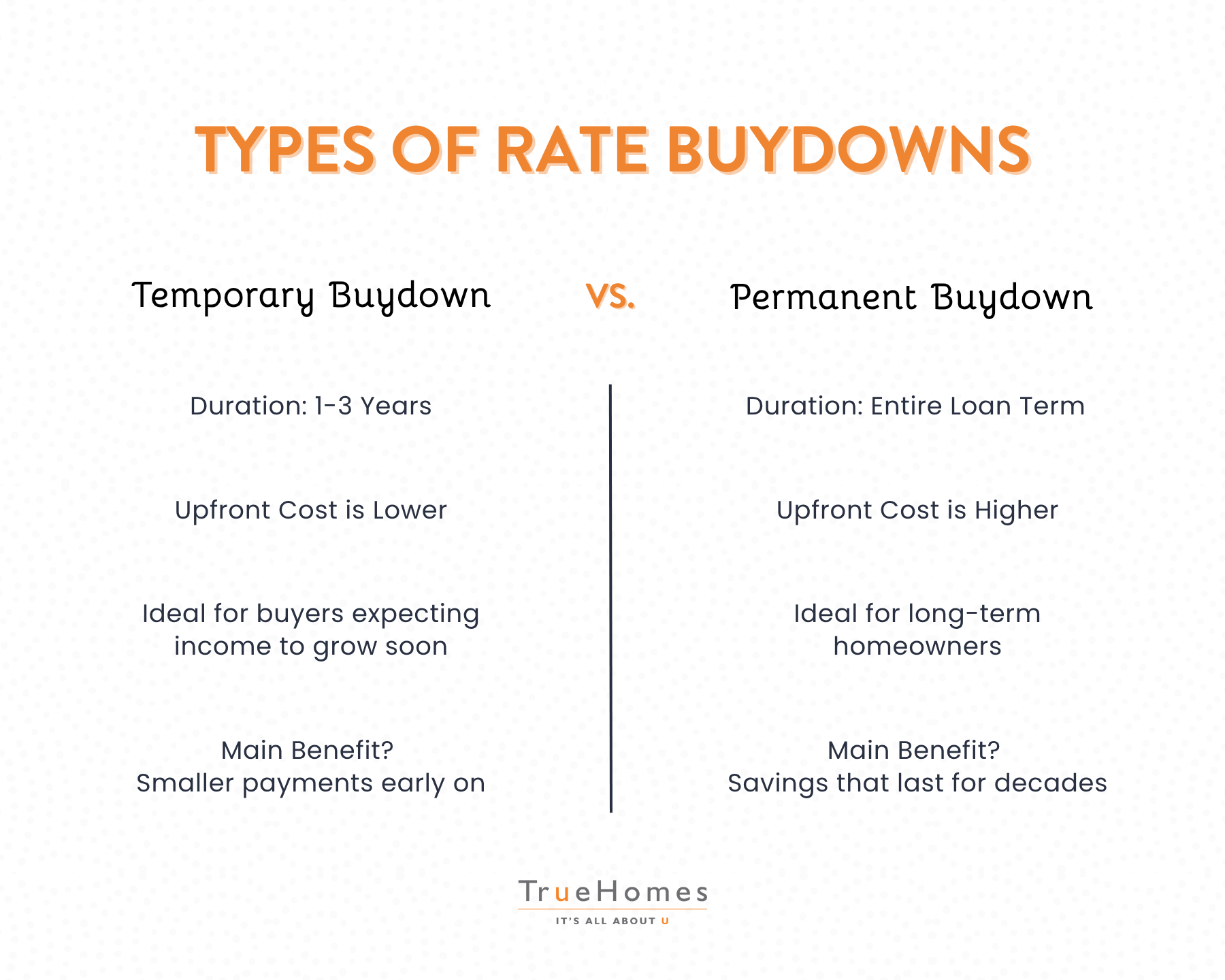

Types of Rate Buydowns: Temporary vs. Permanent

Rate buydowns can be categorized into temporary and permanent types. Each serves different financial goals and timelines. Understanding both types helps in making informed decisions during the mortgage process.

Temporary Buydowns reduce interest rates for the initial years of a loan. This type often benefits those expecting an income increase or financial boost later. During this period, the borrower enjoys manageable monthly payments. Once the buy-down period expires, the interest rate returns to its original level.

Permanent Buydowns offer a reduced interest rate for the life of the loan. This option suits buyers planning to stay in their home long-term. The initial cost is higher, but it pays off over time with continuously lower payments.

Comparison of Buydown Types:

- Temporary Buydown: Short-term rate decrease; lower initial payments.

- Permanent Buydown: Long-term savings; higher upfront cost.

Choosing between these types depends on individual financial circumstances and future plans. Each offers unique advantages, which can be strategic under varying market conditions.

How Much Does It Cost to Buy Down an Interest Rate?

Buying down an interest rate involves an upfront fee typically calculated in points. A point equals 1% of the total mortgage amount. The exact cost depends on the loan size and market rates.

Costs can vary based on how much one wants to lower interest. Generally, each point decreases the rate by approximately 0.25%. Borrowers must weigh these costs against the savings from reduced monthly payments.

Cost Breakdown:

- One Point: 1% of the loan amount.

- Interest Reduction: Usually, 0.25% per point.

- Loan Size Impact: Larger loans require bigger payments per point.

Evaluating this cost is crucial. It impacts long-term savings and overall financial strategy. Knowing the break-even point can guide wise decisions in choosing a buydown option.

Who Can Benefit from a Rate Buydown?

A rate buydown provides borrowers with significant peace of mind, particularly during the initial years of homeownership. By lowering monthly mortgage payments, homeowners can budget more effectively, reducing the financial strain that often accompanies high housing costs. This stability allows for better financial planning, resulting in less stress and greater overall satisfaction in homeownership.

First-time buyers or those with limited initial cash flow might find rate buydowns beneficial. Lower payments during the first few years can provide financial breathing room. It's a strategic move during periods of high interest rates, enhancing affordability.

Beneficial Scenarios:

- Long-term homeownership plans.

- Limited initial cash reserves.

- High-interest-rate environments.

Understanding individual financial situations helps determine if this option aligns with your home-buying goals. Evaluating these factors is key to informed decision-making.

Pros and Cons of Rate Buydowns

Rate buydowns offer several advantages to homebuyers. They can significantly lower monthly payments. This helps especially in the initial years of the mortgage. Another benefit is the potential savings over the life of the loan if the lower rate is long-term.

Pros:

- Reduces monthly mortgage payments.

- Saves money over the life of the loan.

- Makes buying a home more affordable initially.

However, there are downsides to consider. The upfront cost can be quite high. This might not be ideal for everyone, especially those planning to sell soon. Also, there's no benefit if you refinance or pay off the loan early.

Cons:

- Upfront fees can be significant.

- Not beneficial for short-term homeownership.

- Potential losses if refinancing occurs early.

Evaluating both pros and cons helps determine if a rate buydown aligns with your financial goals and timeframe.

Benefits of Rate Buydowns with a Preferred Lender

When you choose to work with a preferred lender through True Homes, you benefit from personalized guidance tailored to your specific situation. Our preferred lenders understand the complexities of the home-buying process and can offer rate buy-down options that align with your financial goals.

- Tailored Solutions: We connect you with lenders who can provide customized mortgage solutions based on where you are in your homebuyer journey.

- Expert Advice: Our preferred lenders are experienced and knowledgeable, ensuring you receive the best advice during your financing journey.

- Flexible Options: No matter the scenario, there is an option for you. Our goal is to help you navigate the mortgage landscape and find a plan that fits your unique circumstances.

By choosing a preferred lender through True Homes, you're not just getting financing; you're gaining a partner in your home-buying journey. We are committed to helping you find the right fit that transforms your homeownership dream into reality.

How to Decide If a Rate Buydown Is Right for You

Deciding on a rate buydown involves careful evaluation. Consider your financial goals and how long you plan to stay in the home. Longevity in the home is key to recouping initial costs.

When weighing your options, it's vital to:

- Determine if you have sufficient funds for upfront costs.

- Analyze your long-term goals and homeownership plans.

- Calculate the break-even point for the buydown investment.

Consulting a mortgage advisor can provide clarity. They can help assess if the potential savings justify the expenses. Don't rush the decision; weighing the pros and cons thoroughly ensures you make a sound financial choice.

Read more from Business Insider on the considerations of buying down your interest rate.

Key Takeaways and Next Steps

Understanding rate buydowns can significantly impact your financial journey. Here's what to remember:

- Evaluate your financial situation before proceeding.

- A rate buydown can reduce your monthly payments.

- Calculate if savings will offset initial costs.

Next, consult a mortgage expert. They can tailor advice to your unique needs. This empowers your decision-making process and ensures financial clarity. Remember that no matter the scenario, there is an option for you to finance your dream home.

Ready to purchase your dream home? Have questions on Rate Buydowns? Contact a True Homes representative today to get started.

FAQ: Interest Rate Buydowns

What is the difference between a temporary and a permanent rate buydown?

A temporary rate buydown lowers your interest rate for the first one to three years of your loan, making your initial payments smaller. After that period, the rate returns to the original agreed rate.

A permanent buydown, on the other hand, reduces your rate for the entire life of the loan in exchange for a higher upfront cost.

Who pays for a rate buydown — the buyer, seller, or builder?

A rate buydown can be funded by the buyer, the seller, or even the homebuilder. In many cases, builders like True Homes offer incentives or partnerships with preferred lenders who can structure a buydown to help buyers secure a more affordable monthly payment.

How much does it cost to buy down an interest rate?

The cost of a rate buydown is typically calculated in points, where one point equals 1% of the total loan amount. Each point usually lowers your interest rate by about 0.25%, though this varies depending on market conditions and lender terms.

Is a rate buydown worth it for first-time homebuyers?

It can be — especially if you’re purchasing during a high-interest-rate market or need lower payments in the early years of ownership.

A buydown helps make monthly payments more manageable while you adjust to new homeownership expenses. It’s best to review your financial goals with a preferred lender to determine if the long-term savings outweigh the upfront cost.